Final Manage gives you full control over how taxes are calculated at checkout using Tax Classes and Tax Rates. Each tax class contains a table of tax rates, each with priority and address fields for full control over how taxes are applied at checkout. Each Station uses the address of its parent Outlet for tax calculation.

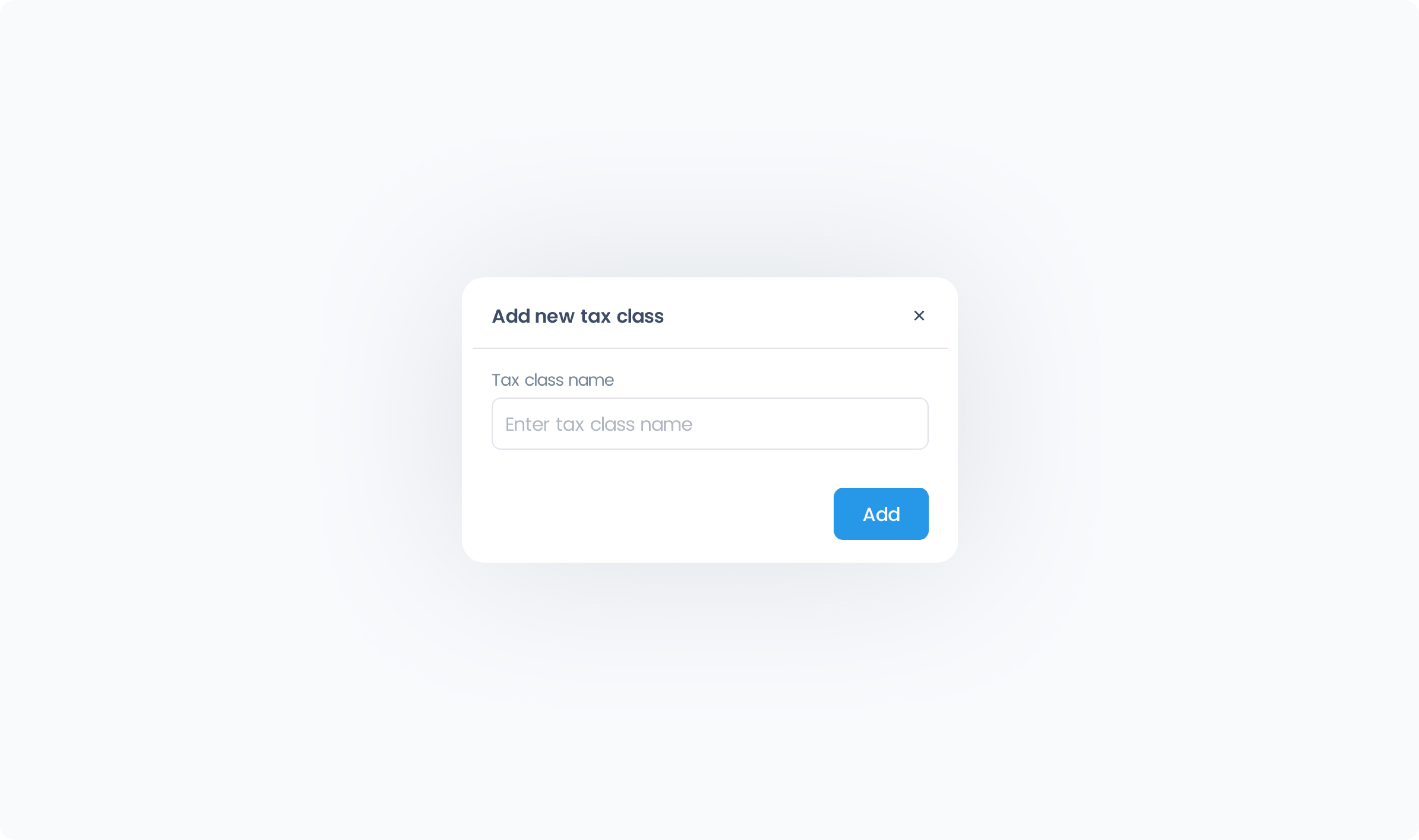

A Tax Class is a group of tax rates that can be assigned to products. Each product can be linked to one Tax Class. This setup allows you to apply the correct tax rules based on the type of item being sold.

You can manage Tax Classes by going to Settings → Taxes in Final Manage.

Each Tax Class contains a tax table — a list of one or more Tax Rates. Each Tax Rate includes:

Rate (%) — the percentage to be applied

Priority — the order in which rates are applied when multiple rates match the Outlet address. Only one matching rate per priority will be applied.

Address filters — such as country, region, or postal code to control when a rate is used.