The Financial Summary report in Manage gives you a high-level overview of sales, taxes, fees, payments, and discounts for a selected date range and set of Outlets. It’s designed to help you assess performance at a glance, with totals grouped by category.

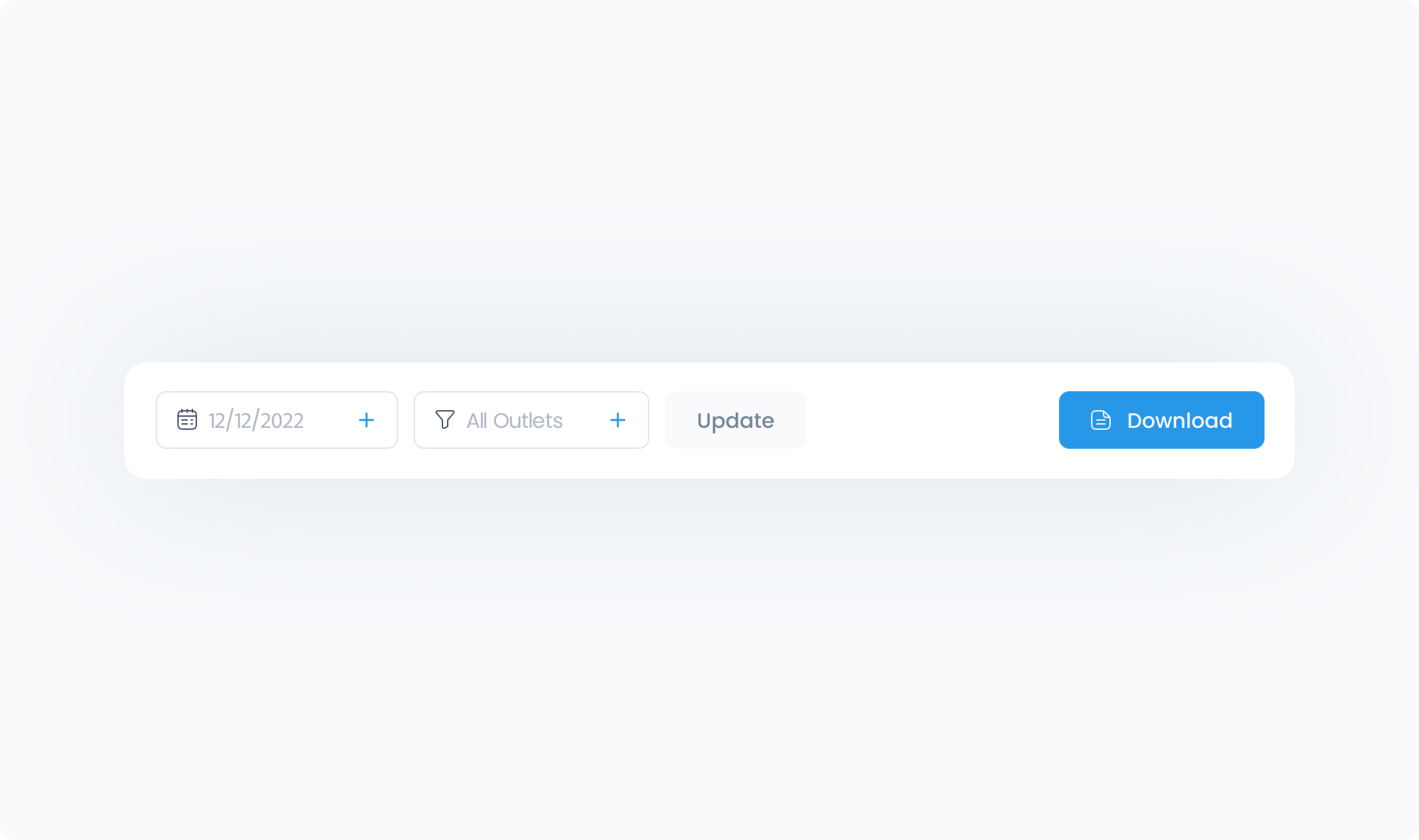

At the top of the page, you can:

Set a date range for the report

Select one or more Outlets to include

Click Update to refresh the report, or Download to save it as a PDF.

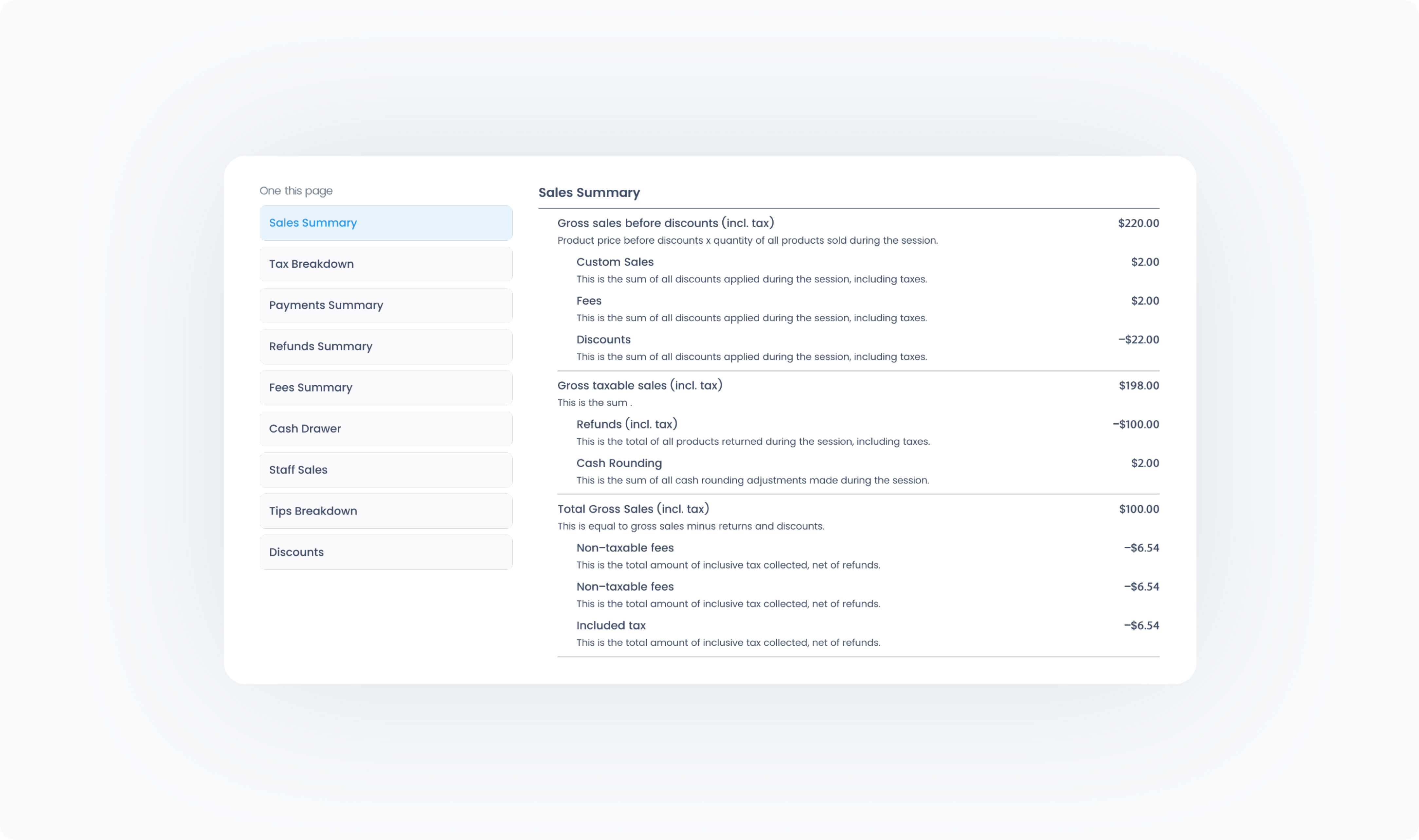

Shows total sales and related adjustments:

Gross Sales – Total including taxes

Taxable Fees – Total of taxable fees (excludes applied taxes)

Discounts – Sum of discounts applied before tax

Gross sales taxable sales – Total excluding taxes

Non-taxable Fees – Total of non-taxable fees applied

Refunds – Subtotal of refunded amounts

Net Sales – Sales excluding taxes

Tax Collected / Tax Refunded – Total tax amounts collected or refunded

Cash Rounding – Total rounding adjustments for cash sales

Total Sales after tax – Net sales plus net tax, adjusted for rounding

Lists each tax rate applied during the period and the total amount collected for it.

Shows fee totals for the selected date range:

Cart fees

Product fees

Combined total fees

Net payments received for each payment type after refunds:

Example: Final Pay, Cash

Includes a combined total of all payments

Lists refunds for each payment type and a total refunds amount.

Totals for each discount type applied, such as:

Product Discount

Card Discount

Combined total of all discounts